Financing the Future — Empowering Growth & Infrastructure

Nirmal Capital connects government agencies and corporates with global capital sources to structure reliable, compliant, and efficient funding solutions for large-scale projects and corporate growth.

Chat on WhatsApp

Trusted by Institutions

15+ years advising governments, corporates and institutional capital across infrastructure and corporate finance.

Strategic Capital. Measured Execution. Long-term Impact.

Nirmal Capital is a focused advisory boutique that structures and secures funding for large-scale projects and corporate growth. We combine rigorous financial analysis, regulatory expertise, and deep relationships with sovereign and institutional investors to deliver finance strategies that are transparent, durable and outcome-driven. Our advisory is designed to reduce execution risk and accelerate the path from planning to financing and delivery.

Project Finance

Infrastructure, energy & public works

Investor Access

Sovereign funds & global institutions

Our Services

Nirmal Capital offers end-to-end advisory and funding solutions — enabling sustainable project financing, responsible corporate growth, and trusted investor relationships.

Government Infrastructure Project Funding

We help governments access bilateral and institutional capital to accelerate infrastructure growth with regulatory alignment and fiscal responsibility.

Priority

Corporate Finance

Advisory on capital raising, M&A, and investor strategy — helping corporations strengthen financial structures and unlock new growth opportunities.

Corporate

Debt Capital Markets

End-to-end structuring and placement of debt instruments, ensuring efficient access to capital markets through compliant and strategic execution.

Markets

Green Bonds

Development and placement of ESG-linked instruments that fund renewable and sustainable infrastructure for a responsible future.

ESG

Project Finance

Comprehensive solutions for large capital projects — feasibility, risk structuring, and investor syndication ensuring long-term financial viability.

Structured

Structured Finance & Real Estate (REITs/InvITs)

Tailored financial structures and credit enhancement strategies — unlocking liquidity and optimising assets for institutional investors.

Real Estate

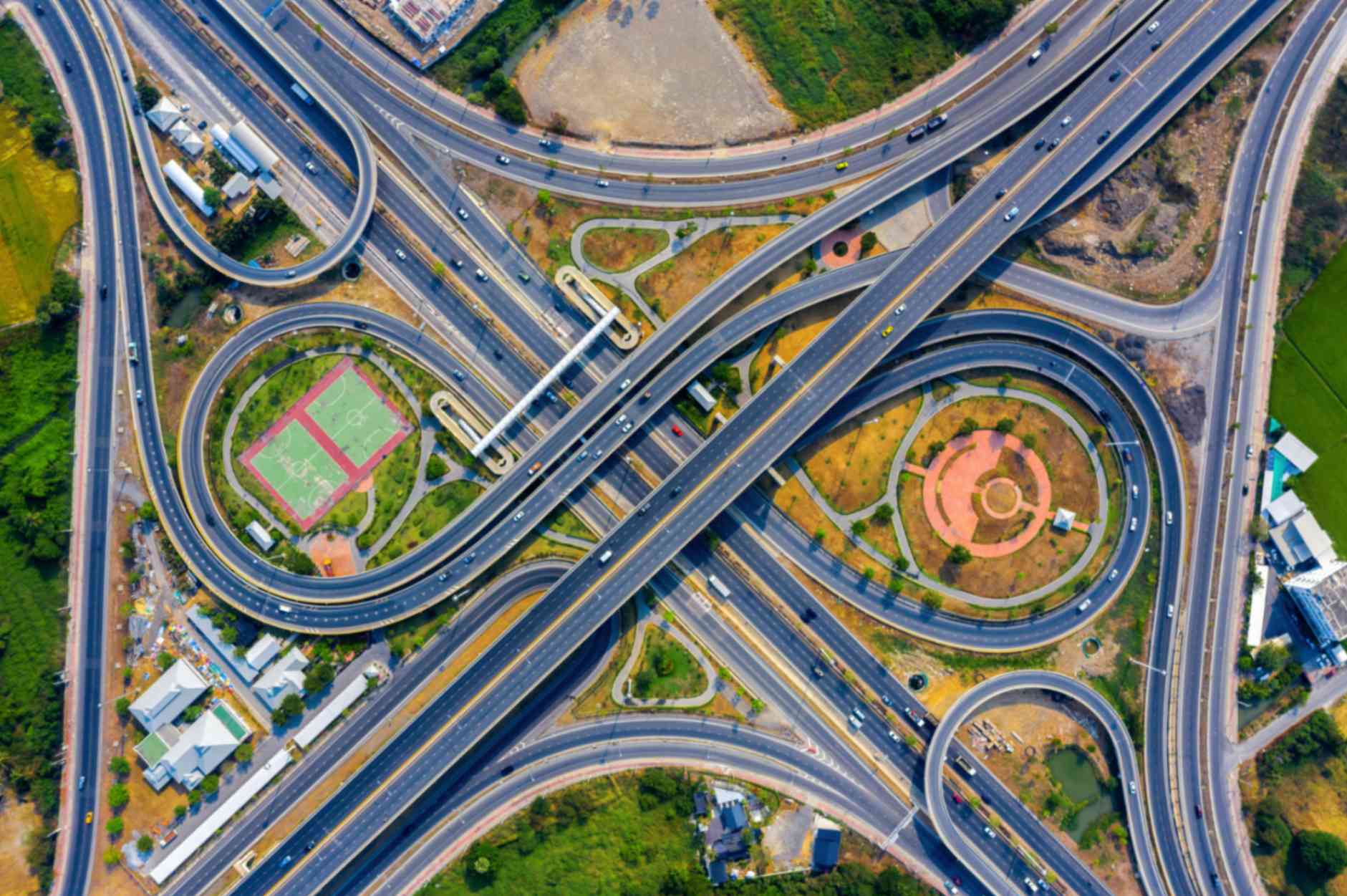

Empowering Infrastructure through Strategic Funding

Nirmal Capital connects infrastructure initiatives with reliable international capital sources, delivering seamless execution from feasibility to financial closure. Our team structures financing that sustains growth, innovation, and nation-building at scale.

Learn More

Corporate Partnerships with Purpose and Precision

We provide structured capital solutions and strategic advisory for corporates seeking long-term partnerships, global investor confidence, and regulatory compliance — ensuring financial frameworks that empower lasting impact.

Learn MoreWhy Choose Nirmal Capital

We blend deep financial expertise with regulatory understanding and execution precision — empowering businesses, governments, and investors to grow with confidence and integrity.

Expert Financial Structuring

Our advisory process is driven by data, diligence, and a deep understanding of multi-sector funding strategies — ensuring precise execution every time.

Global Network Access

We collaborate with global institutional lenders, sovereign funds, and investors to unlock large-scale infrastructure and corporate finance opportunities.

Transparent & Compliant Process

Every engagement follows strict governance and regulatory standards, giving our clients complete transparency and confidence at each stage.

What our clients say

Trusted by government bodies, institutional investors and private corporations — here are a few highlights from our partnerships and outcomes.

“Nirmal Capital helped us bridge a complex funding gap on a state infrastructure project. Their structuring and investor engagement were instrumental in achieving financial close on schedule.”

“Their capital markets expertise enabled our IPO readiness and bond issuance. The team combined technical skill with practical advice — we appreciated the clarity at each step.”

“Nirmal’s diligence and structuring made our commitment straightforward. Their team is responsive, technically strong, and pragmatic in negotiation.”

Frequently Asked Questions

Answers to the most common queries about our financial advisory, project funding, and corporate services — helping you understand how we work and what makes us different.